Tax Credits for Energy Efficiency: Insulation, Air Sealing, Solar

August 10, 2021

In the United States, buildings account for about 40% of all energy consumption and greenhouse gas emissions. It is because of this that the US Government prioritizes and energy efficiency through code requirements and incentivizes upgrades through residential energy tax credits.

Tax credits are available to homeowners who make their homes more energy-efficient by installing certain equipment including insulation, air sealing, and solar attic fans.

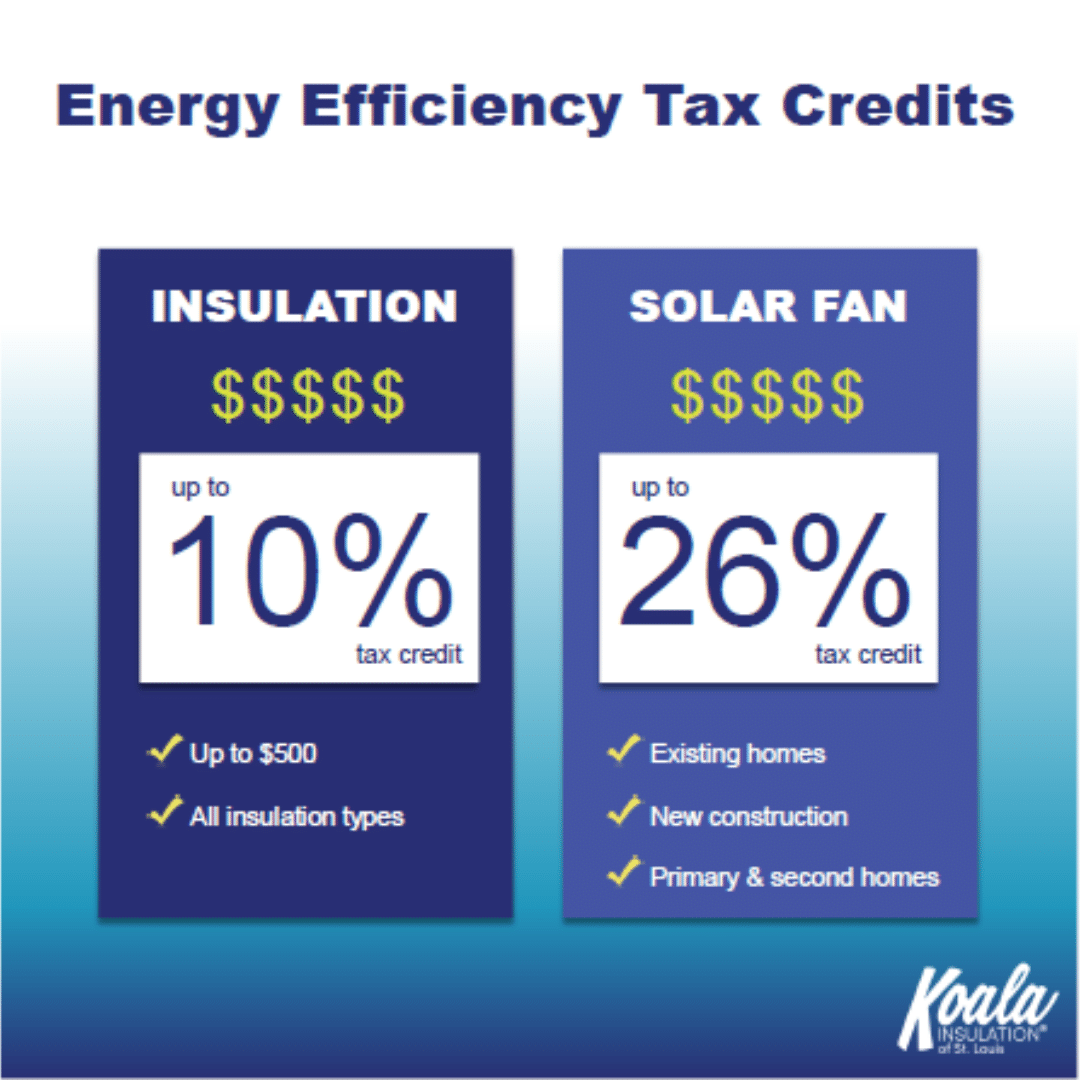

Federal Tax Credits for Insulation

Adding insulation is one of the most cost-effective home improvements that can be done, just don't make these common DIY mistakes. It's always best to hire a professional.

Tax Credit Amount: 10% of the cost, up to $500 (not including installation labor costs)

Expires: December 31, 2021

Details: Must be an existing home & your principal residence. New construction and rentals do not qualify for this tax credit.

Requirements: Typical bulk insulation products can qualify, such as batts, rolls, blow-in fibers, rigid boards, expanding spray, and pour-in-place.

Federal Tax Credits for Air Sealing

Air sealing can be nearly as important as insulation to reducing energy consumption and keeping your home cool in the summer. Products that air seal (reduce air leaks) can also qualify, as long as they come with a Manufacturers Certification Statement, including:

Tax Credit Amount: 10% of the cost, up to $500 (not including installation labor costs)

Expires: December 31, 2021

Details: Must be an existing home & your principal residence. New construction and rentals do not qualify for this tax credit.

Requirements: Weather stripping, Spray foam in a can (designed to air seal), Caulk designed to air seal, House wraps

Federal Tax Credits for Solar

Attic fans provide ventilation that keeps attics cool and reduce energy consumption to cool residential homes. Solar attic fans have numerous benefits, including the qualification for the Solar Tax Credits.

Tax Credit Amount: 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. (includes installation labor costs)

Expires: 2024

Details: Must be installed at your primary or secondary residence.

Requirements: Solar Attic Fans

Contact Koala Insulation of St. Louis, your local insulation contractor, today to get started! And check out our recent blog post to find out why insulation is extra important in St. Louis.

www.koalainsulation.com/saint-louis

(314)-279-5064

Ready to book your free insulation evaluation?

We have 3 convienant ways for you to get in touch

We Provide Insulation Services to the Following St. Louis Areas

FLORISSANT, MARYLAND HEIGHTS, SAINT ANN, SAINT LOUIS, BELLEVILLE, COLUMBIA, MILLSTADT, ARNOLD, BARNHART, CEDAR HILL, CRYSTAL CITY, EUREKA, FESTUS, HERCULANEUM, HIGH RIDGE, HILLSBORO, HOUSE SPRINGS, IMPERIAL, LABADIE, PACIFIC, PEVELY, SAINT ALBANS, AUGUSTA, DEFIANCE

Counties Served

SAINT LOUIS, SAINT CLAIR, MONROE, SAINT LOUIS CITY, JEFFERSON, FRANKLIN, SAINT CHARLES

Zip Code

63031, 63033, 63034, 63043, 63074, 63134, 63135, 63140, 63145, 63146, 62220, 62221, 62223, 62226, 62236, 62260, 63109, 63111, 63116, 63123, 63125, 63129, 63102, 63103, 63104, 63105, 63108, 63110, 63112, 63114, 63118, 63130, 63132, 63133, 63139, 63010, 63012, 63016, 63019, 63025, 63028, 63048, 63049, 63050, 63051, 63052, 63055, 63069, 63070, 63073, 63332, 63341